The Federal Reserve Board on Thursday launched its hypothetical eventualities for a next spherical of financial institution anxiety exams. Before this year, the Board’s 1st spherical of anxiety exams discovered that large banking institutions were being properly capitalized below a assortment of hypothetical gatherings. An supplemental spherical of anxiety exams is remaining done owing to the continued uncertainty from the COVID party.

Substantial banking institutions will be tested against two eventualities showcasing significant recessions to assess their resiliency below a assortment of results. The Board will release company-particular outcomes from banks’ performance below equally eventualities by the conclusion of this year.

The Board’s anxiety exams aid assure that large banking institutions are equipped to lend to homes and firms even in a significant recession. The work out evaluates the resilience of large banking institutions by estimating their loan losses and capital levels—which present a cushion against losses—under hypothetical recession eventualities above nine quarters into the future.

“The Fed’s anxiety exams before this year showed the toughness of large banking institutions below numerous distinct eventualities,” Vice Chair Randal K. Quarles said. “Though the financial state has enhanced materially above the very last quarter, uncertainty above the course of the upcoming couple of quarters remains unusually higher, and these two supplemental exams will present much more information and facts on the resiliency of large banking institutions.”

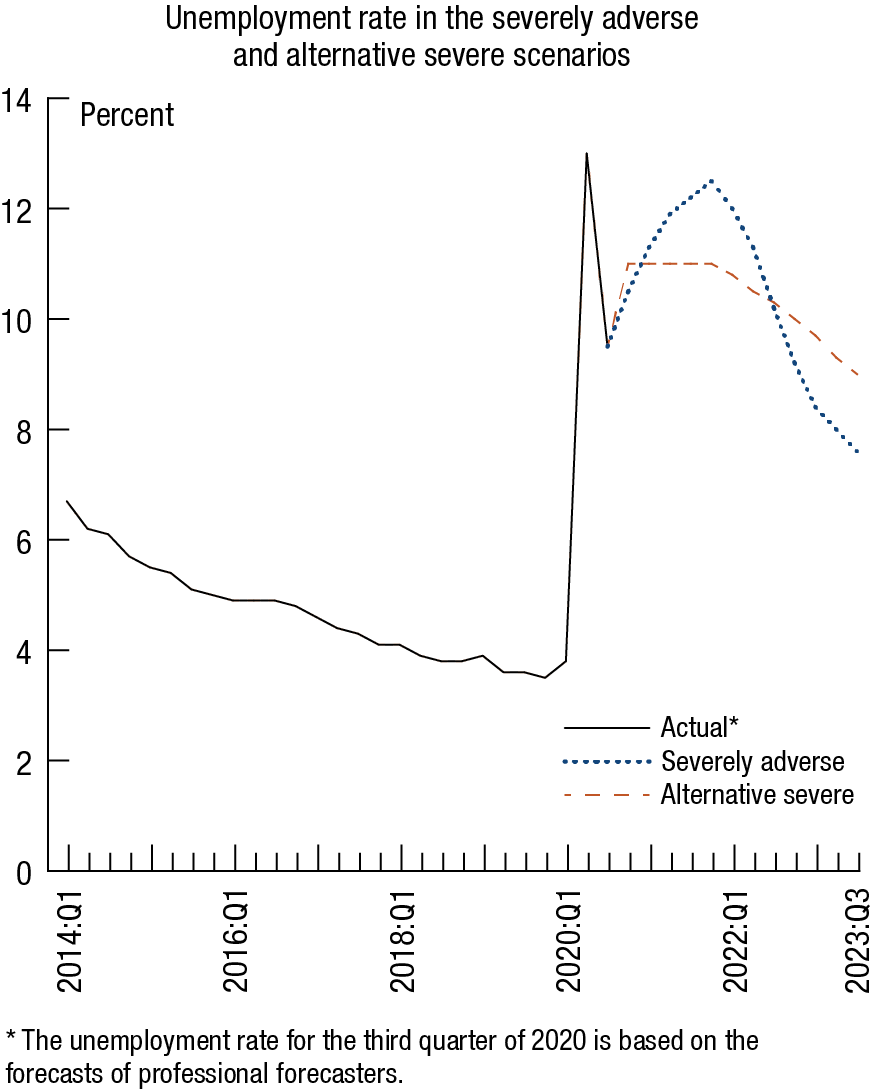

The two hypothetical recessions in the eventualities feature significant world downturns with substantial anxiety in economic markets. The 1st scenario—the “severely adverse”—features the unemployment charge peaking at 12.5 percent at the conclusion of 2021 and then declining to about seven.5 percent by the conclusion of the situation. Gross domestic solution declines about 3 percent from the 3rd quarter of 2020 by the fourth quarter of 2021. The situation also capabilities a sharp slowdown overseas.

The next scenario—the “option significant”—features an unemployment charge that peaks at eleven percent by the conclusion of 2020 but stays elevated and only declines to nine percent by the conclusion of the situation. Gross domestic solution declines about two.5 percent from the 3rd to the fourth quarter of 2020. The chart underneath demonstrates the route of the unemployment charge for each individual situation.

The two eventualities also contain a world industry shock element that will be applied to banking institutions with large buying and selling functions. Those people banking institutions, as properly as specified banking institutions with substantial processing functions, will also be needed to include the default of their premier counterparty. A desk underneath demonstrates the elements that utilize to each individual company.

The eventualities are not forecasts and are drastically much more significant than most existing baseline projections for the route of the U.S. financial state below the anxiety tests period of time. They are intended to assess the toughness of large banking institutions through hypothetical recessions, which is specifically acceptable in a period of time of uncertainty. Each situation contains 28 variables covering domestic and global economic action.

In June, the Board launched the outcomes of its yearly anxiety exams and supplemental analyses, which discovered that all large banking institutions were being sufficiently capitalized. Even so, in light-weight of the heightened economic uncertainty, the Board needed banking institutions to just take many steps to protect their capital ranges in the 3rd quarter of this year. The Board will announce by the conclusion of September irrespective of whether people steps to protect capital will be extended into the fourth quarter.

| Financial institution | Matter to world industry shock | Matter to counterparty default |

|---|---|---|

| Ally Fiscal Inc. | ||

| American Specific Company | ||

| Financial institution of The united states Corporation | X | X |

| The Financial institution of New York Mellon Corporation | X | |

| Barclays US LLC | X | X |

| BMO Fiscal Corp. | ||

| BNP Paribas Usa, Inc. | ||

| Capital Just one Fiscal Corporation | ||

| Citigroup Inc. | X | X |

| Citizens Fiscal Group, Inc. | ||

| Credit rating Suisse Holdings (Usa), Inc. | X | X |

| DB Usa Corporation | X | X |

| Learn Fiscal Solutions | ||

| DWS Usa Corporation | ||

| Fifth Third Bancorp | ||

| The Goldman Sachs Group, Inc. | X | X |

| HSBC North The united states Holdings Inc. | X | X |

| Huntington Bancshares Included | ||

| JPMorgan Chase & Co. | X | X |

| KeyCorp | ||

| M&T Financial institution Corporation | ||

| Morgan Stanley | X | X |

| MUFG Americas Holdings Corporation | ||

| Northern Trust Corporation | ||

| The PNC Fiscal Solutions Group, Inc. | ||

| RBC US Group Holdings LLC | ||

| Regions Fiscal Corporation | ||

| Santander Holdings Usa, Inc. | ||

| Condition Road Corporation | X | |

| TD Group US Holdings LLC | ||

| Truist Fiscal Corporation | ||

| UBS Americas Keeping LLC | X | X |

| U.S. Bancorp | ||

| Wells Fargo & Company | X | X |

For media inquiries, connect with 202-452-2955