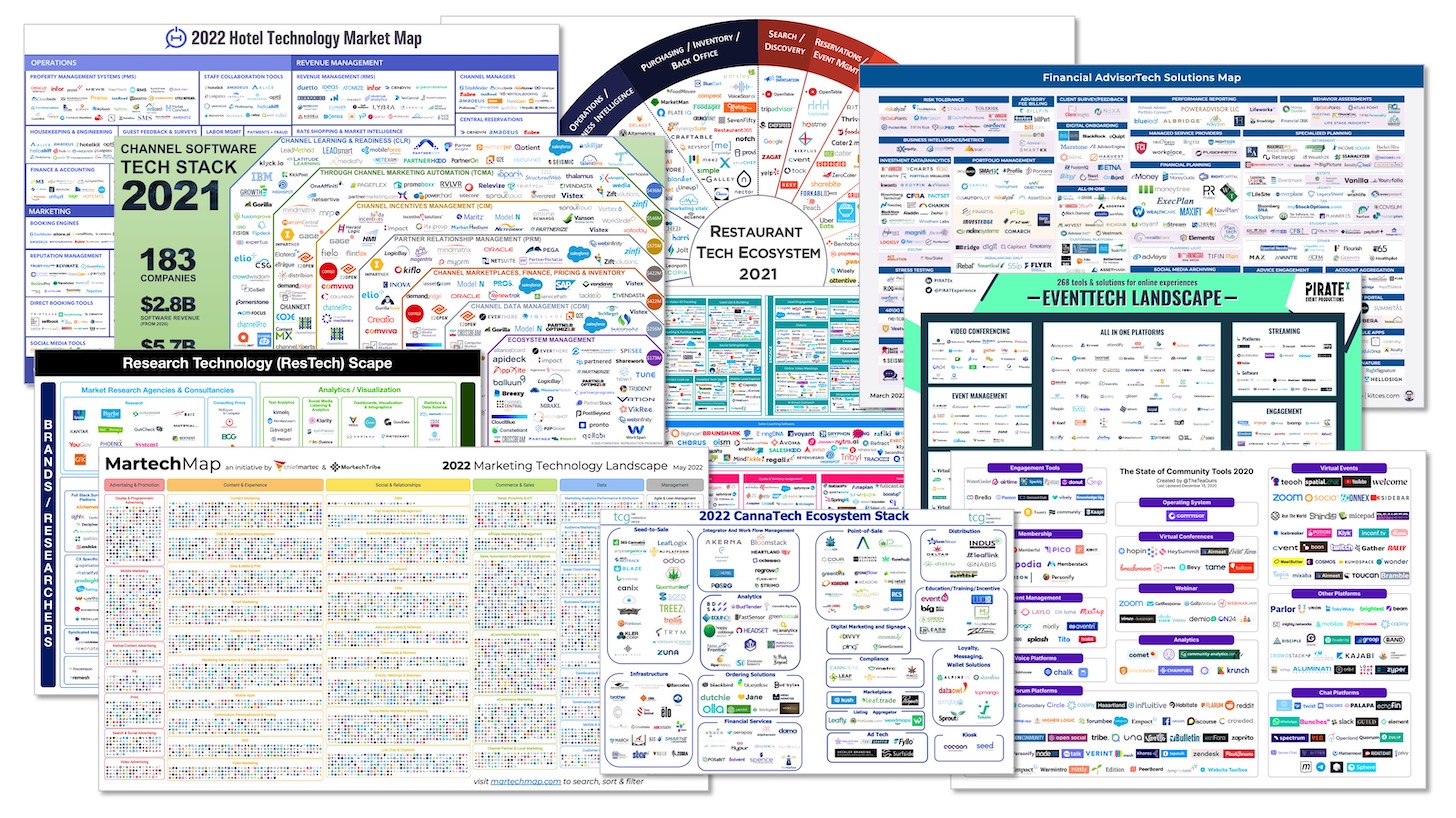

In excess of the 11 many years that I’ve been publishing the martech landscape, as it mushroomed from ~150 alternatives to ~10,000, I’ve noticed quite a few individuals respond to it as an anomaly. “What is it about advertising that spawns so quite a few application apps? Certainly no other career has to offer with this kind of sprawl!”

To which software program evaluation website G2 responds in this posting, “Hold my beer.”

While there are definitely dynamics precise to marketing and advertising that feed the frenzy of new martech startups, the reality is that martech is just a element of a significantly larger software program revolution. Marc Andreessen identified as it “software feeding on the entire world.” I simply call it The Great App Explosion. Program is everywhere you go (and, progressively, anything is software).

But exactly how numerous commercially packaged program applications are there in The Terrific Application Explosion?

Let’s take online games and purchaser-oriented apps off the desk. We know there are millions of this kind of apps for cell products on the Apple Application Retail outlet and Google Enjoy Keep. It’s reasonable to say that’s a various kettle of fish than B2B program, this kind of as martech.

Perfectly, at least currently. Frankly, client and enterprise software program applications are run by a lot of the very same fundamental technological innovation. And you see growing cross-pollination amongst those people domains. The consumerization of IT continues to be a big movement underway. I individually see similarities in between creators on purchaser platforms and “makers” within providers leveraging no-code instruments. And if you consider the buzz of the metaverse — which will one working day rise from the trough of disillusionment — the convergence of business and shopper encounters will blur even additional.

But for now, let us adhere to a narrow interpretation of how a lot of business enterprise program apps are there in the environment?

The reply: at the very least 103,528.

That is the range of computer software merchandise profiled on G2’s website as of last week. It’s not a theoretical guesstimate. It’s an empirical count — like the martech landscape, but spanning all business software program types.

I emphasised the phrase “at least” in front of that quantity for two explanations:

First, G2 acknowledges that they haven’t uncovered all of the small business software program applications out there but. My impact is that primarily in markets outside the house of North The usa, there’s a ton nonetheless to uncover. Believe of China and Japan, for occasion.

2nd, new software program startups preserve being launched. (You could be mumbling beneath your breath, “Let’s see what the recent economy does to that merry-go-spherical.” Place a pin in that caveat for a minute – I’ll arrive back to it.)

In other text, that 103,528 amount is a decrease sure of the B2B software product or service universe. The genuine range is absolutely bigger, and most likely a lot increased. 150,000? 200,000? A lot more?

G2’s databases is surely still developing, including on common 945 application merchandise per month.

What about consolidation, you say? These figures from G2 are inclusive of the simple fact that they’ve taken care of more than 760 merger and acquisition conditions due to the fact January of this year. So, sure, consolidation is happening. But the paradox of simultaneous consolidation and enlargement in software markets retains true. It is not just martech.

Speaking of martech, the folks at G2 also shared with me the counts of 9,365 martech solutions and 1,488 adtech products in their database. Put together — which is how I have generally thought of them — that’s 10,853 madtech applications in overall. Much more than what Frans and I came up with in our 2022 martech landscape release in May well.

Our strategy is to share information among us and G2 to get a superset of all of them. But it’s awesome to also have an unbiased corroboration that, of course, today’s martech landscape seriously is on the magnitude of ~10,000 solutions.

Is 2023 the Yr of the Martech Cataclysm?

But let’s get back again to that query about the financial system I dodged before.

No sugarcoating it. This future 12 months or two is heading to exert a ton of force on the latest martech landscape. Funding will be tougher to arrive by, and at substantially extra modest valuations. Marketing and advertising departments are likely to have tighter budgets and turn into much harder shoppers when it comes to considering and negotiating martech buys. This is the to start with time in more than a 10 years of exponential martech progress that the industry is facing a genuinely formidable economic setting.

Without doubt, this will end result in several much more acquisitions of lesser martech fish by even bigger martech fish, as very well as the non-public fairness crowd betting on the other aspect of this cycle. But extra painfully, there will be an expanding range of early-stage martech ventures that basically call it quits just after failing to either protected their next funding spherical, find a ready acquisitor, or rebalance their operations to profitability.

My very best guess? Up to 20% of the existing martech landscape could churn just before 2024.

But it is only the churn level of existing martech sellers that I have a darkish prediction about. As significantly as collective field income goes, I believe martech is likely to proceed to improve for the foreseeable upcoming. Perhaps not as rapidly as it has been for the future few of many years. But in the significant photo, even now fairly quick. For 1 straightforward rationale: the electronic transformation of marketing and advertising is significantly from around, and it stays a single of the greatest levers every enterprise on the earth has for winning and retaining prospects.

Especially in the tough times forward, wonderful martech will be crucial to survival accomplishment.

Fail to remember valuations for now, which have been the semi-delusional yardstick of measuring martech ventures these previous couple several years. Profits is the floor truth of sizing an market. And I’m 99.9% selected martech earnings will increase calendar year-above-calendar year for the rest of this 10 years.

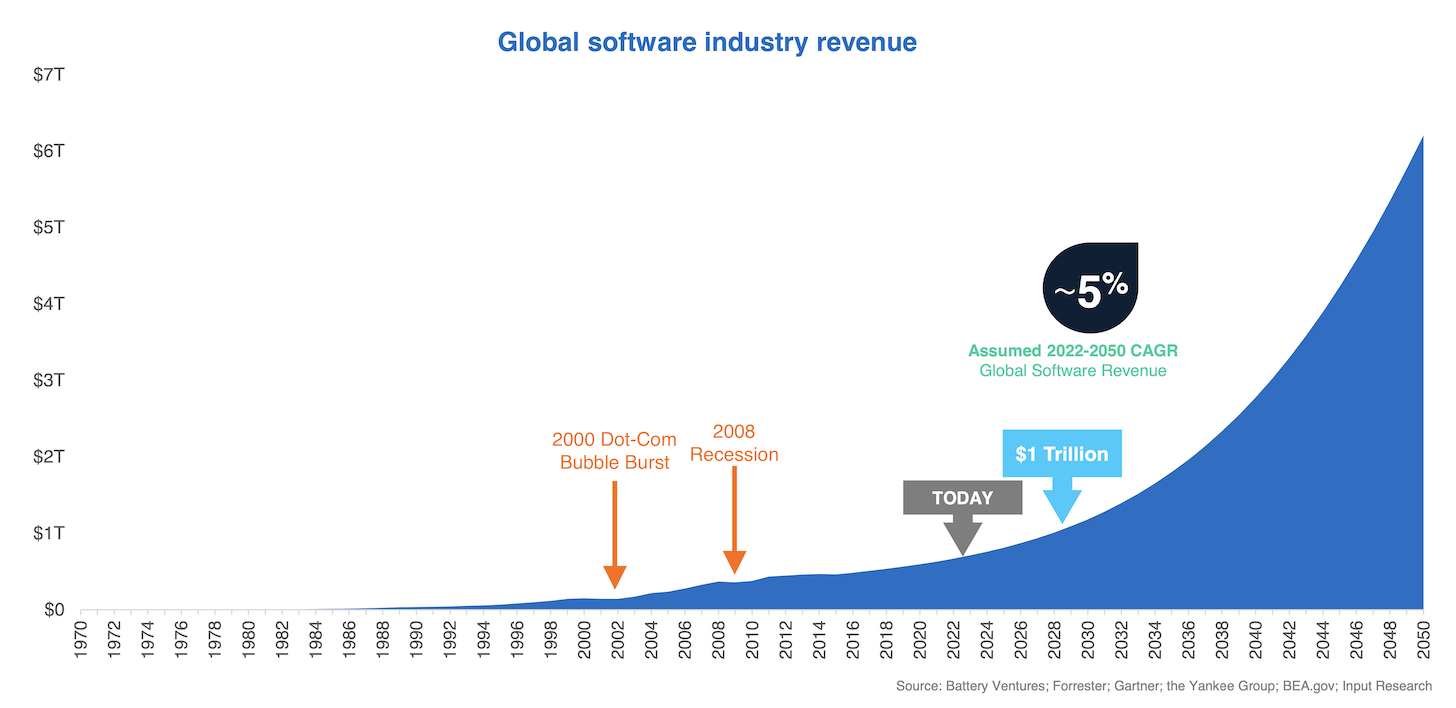

And to repeat the mantra of this publish: it’s not just martech. The full application field has great development forward of it. The inspiring chart over from Battery Ventures (with my two annotations in orange) is both equally an accurate appear-back at computer software income expansion around the past five a long time, but also a relatively conservative extrapolation of ordinary compound annual progress of program profits for the future two many years.

Two points pop out right away from that chart:

To start with, holy cats, the dimension of what the software package business is most likely to grow to by 2050 dwarfs the place we are currently. “Software consuming the world” is software package having around far more and a lot more of each aspect of the economy. All over the world GDP in 2020 was ~$85 trillion. By 2050, it is anticipated to be ~$165 trillion. It is essentially not that ridiculous to believe of software earning up a mere $6 trillion of that, or ~3.6% of complete GDP.

Next, the Dot-Com Bubble Burst in 2000 and The Great Economic downturn in 2008 barely register as tiny dents in the upward slope of this mountain. Which is not to trivialize the complications so quite a few confronted in these a long time. But putting all those hurdles in viewpoint of the prolonged match, the general trajectory of the program industry hasn’t been derailed by the ups-and-downs of macroeconomic company cycles. I assume that is going to continue being legitimate for this generation and likely the upcoming.

All of which qualified prospects me to conclude that The Great Application Explosion will carry on through these following couple of a long time. And on the up coming wave of recovery and expansion, the development in new program apps could possibly really well strike light-weight velocity ludicrous pace.